Patrycja Boryka and

Paul Johnson,East Yorkshire & Lincolnshire

Getty Images

Getty ImagesHe made his name on a voyage around the world alongside Captain James Cook, before becoming a friend of King George III and…

Patrycja Boryka and

Paul Johnson,East Yorkshire & Lincolnshire

Getty Images

Getty ImagesHe made his name on a voyage around the world alongside Captain James Cook, before becoming a friend of King George III and…

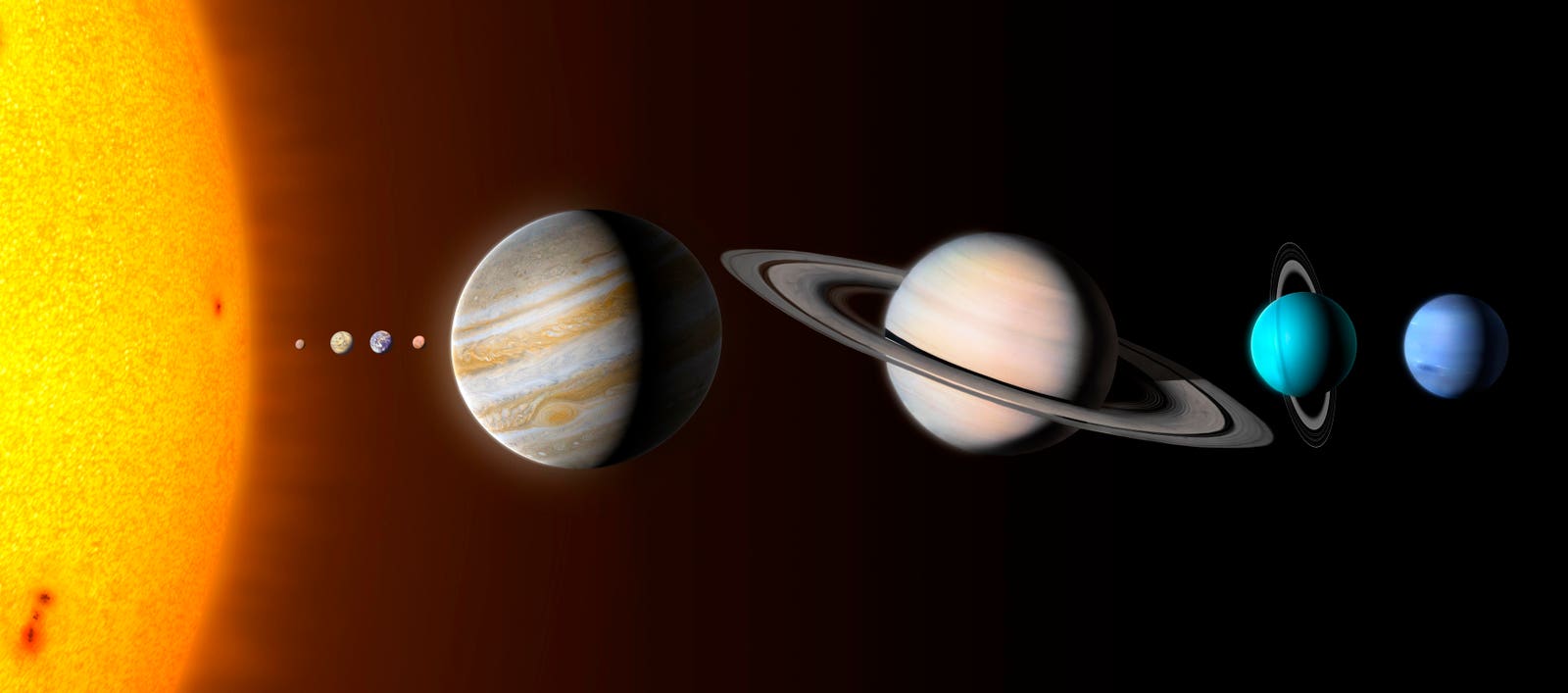

Illustration comparing the planets of the Solar System and the Sun on the same scale. The planets are shown to scale relative to each other but their distances are not. From left to right the bodies are: the Sun, Mercury, Venus, Earth, Mars,…

On October 25, 2025, I attended the NASCAR car race in Bakersfield,…

Realizing that the advent of AGI and ASI could trigger a dire AI-driven extinction-level event that wipes us all out.

getty

In today’s column, I examine the widely debated and quite distressing contention that once we attain artificial general…

ASEAN shall develop friendly relations and mutually beneficial dialogues, cooperation and partnerships with countries and sub-regional, regional and international organisations and institutions. This includes external partners, ASEAN…

Kirin Holdings Company (TSE:2503) shares have edged higher over the past month, drawing attention from investors interested in the food and beverage sector. The stock’s upward trend raises questions about what is driving recent sentiment.

See our latest analysis for Kirin Holdings Company.

Kirin’s share price has climbed 11.3% over the past three months, reflecting a wave of renewed optimism about its growth outlook, while the total shareholder return over the past year sits at 1.5%. Investors watching this steady uptrend may be sensing improving fundamentals and a potential rerating on valuation, especially as the sector sees pockets of positive momentum.

If you’re looking to broaden your search for fresh opportunities, consider exploring fast growing stocks with strong insider ownership. fast growing stocks with high insider ownership

The question now is whether Kirin’s recent rally still offers attractive value for new investors, or if the market has already factored in the company’s potential for future growth. Is there a buying opportunity left?

Kirin Holdings trades at a price-to-earnings ratio of 33.4 times, which is notably higher than both its industry average and the fair multiple suggested by valuation models. The current share price of ¥2,221.5 puts this premium in focus.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each unit of the company’s earnings. For an established food and beverage group like Kirin, this number reflects market expectations for profit stability, future growth, and sector competitiveness. However, such a high P/E raises the question of whether recent optimism is running ahead of underlying performance.

Compared to the Asian Beverage industry average of 19.6x, Kirin’s stock is expensive. It also exceeds the company’s own estimated fair P/E of 30.5x, suggesting the stock could be priced for stronger growth or efficiency gains than currently forecast. If expectations reset, the market could drive the multiple closer to this fair ratio in the future.

Explore the SWS fair ratio for Kirin Holdings Company

Result: Price-to-Earnings of 33.4x (OVERVALUED)

However, slower revenue growth or shifts in market sentiment could quickly cool enthusiasm and put downward pressure on Kirin’s current valuation premium.

Find out about the key risks to this Kirin Holdings Company narrative.

While Kirin looks expensive based on its price-to-earnings ratio, the SWS DCF model offers a very different takeaway. According to this approach, the stock is trading at a steep 60% discount to its estimated fair value of ¥5,552.77. This suggests that, even after its recent run, the market may be overlooking longer-term cash flow potential. Could investors be underestimating Kirin’s future growth, or is there something the DCF is not capturing?

A confusing October for WIndows users

NurPhoto via Getty Images

A confusing October for Microsoft users. Windows 10 has finally reached its end-of-life with hundreds of millions stranded on the retiring OS. Meanwhile, those who have upgraded to…

PARIS — The robbery at the Louvre has done what no marketing campaign ever could: It has catapulted France’s dusty Crown Jewels — long admired at home, little known abroad — to global fame.

One week on, and the country is still wounded by…